Legacy & Leverage

Transforming Charitable Giving Through Strategic Trusts

Charitable giving and tax planning are often treated as separate worlds, but there is one strategy that blends the two with remarkable efficiency. The Charitable Lead Annuity Trust, or CLAT, allows donors to direct meaningful support to charitable organizations while simultaneously reducing transfer taxes and preserving family wealth. When structured properly, a CLAT can channel millions into causes like hospitals, universities, or community foundations, while allowing heirs to receive substantial remainder interests with little or no gift or estate tax liability.

How CLATs Work: Combining Charity and Family Legacy

A traditional CLAT is straightforward. The donor funds the trust, which then pays a fixed annual annuity to a foundation or charity for a defined term, often 10 to 20 years. When the term ends, the remaining assets go to the donor’s beneficiaries. If a trust is funded with $10 million and pays $500,000 annually to a university foundation for 20 years, that organization receives a reliable stream of $10 million over the life of the trust. At the same time, any growth in excess of that obligation accrues to the remainder beneficiaries. This dual benefit, charitable support today, family legacy tomorrow, is what makes the CLAT so compelling.

The valuation of the charitable interest is calculated using the IRS 7520 rate. When rates are low, the present value of the annuity stream is high, which increases the donor’s charitable deduction. But even in higher rate environments, careful structuring keeps CLATs attractive, especially when the donor’s goal is to remove appreciating assets from their estate and ensure that growth compounds outside the reach of estate taxes.

Advanced Strategies: Shark Fin CLATs and ECLATs

While the traditional version is powerful, advanced designs have emerged to maximize efficiency. The first major evolution was the shark fin CLAT, so named because its payout schedule looks like a fin. In this model, the charity receives only minimal payments in the early years and then one very large balloon payment near the end of the term. This allows the trust’s assets to remain invested and compounding for a longer period before being distributed. For heirs, the remainder value can be significantly higher. For charitable organizations, however, most of the benefit comes late in the trust’s life, which may not align with their immediate funding needs.

That tension led to the development of the Enhanced CLAT, or ECLAT. Where the shark fin model is extreme, the ECLAT is carefully engineered. Payments start smaller and then gradually increase over the life of the trust. The result is a schedule that allows growth to build inside the trust in the early years, while still providing the foundation or charitable organization with meaningful and increasing support as time goes on. From a university’s perspective, the ramp up in payments can be built into long term endowment planning. For a hospital, it can support capital campaigns that require resources at increasing levels over time. And from the donor’s perspective, the structure preserves much of the compounding advantage while ensuring compliance.

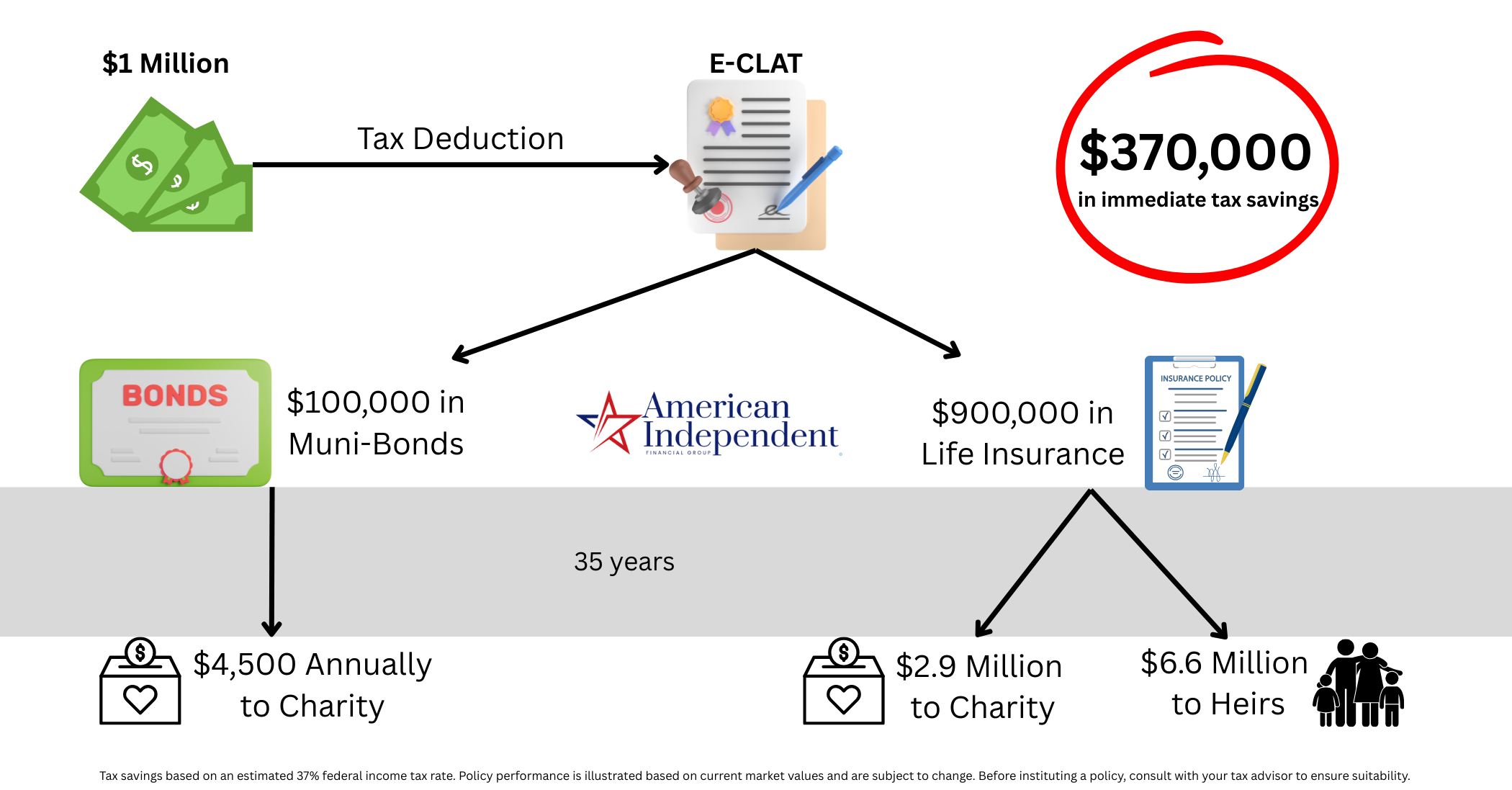

A hypothetical 55-year-old client wishes to donate $2.9 million to her alma mater at death. Utilizing the ECLAT strategy, she contributes $1 million to the trust.

Charitable distribution: $100,000 purchases long term municipal bonds, generating $4,000 per year for distribution to the university.

Growth component: The remaining $900,000 is placed into a uniquely designed cash accumulation life insurance policy.

Immediate tax benefit: She receives an income tax deduction of $1 million, producing $370,000 in tax savings that can be invested in a side account at her discretion.

At her death, the university receives $2.9 million, while her heirs receive $6.6 million. The side account, projected to grow at 4.5% after tax, can provide an additional sum for heirs even after estate tax.

How an ECLAT works, illustrated.

The ECLAT represents a balance. It offers charities the comfort of consistent and growing funding, while giving donors confidence that they are maximizing the long term value passed to their families. It avoids the compliance risk of an extreme back loaded payout, but still captures the efficiency that makes shark fin structures appealing.

Real-World Impact: Supporting Foundations While Preserving Wealth

Consider a donor who funds a $5 million ECLAT for 20 years. In the early years, the charitable organization might receive $200,000 annually, increasing gradually to $750,000 or more by the later years. Over two decades, the foundation receives a growing stream of dollars that reflect both generosity and foresight. Meanwhile, the remainder of the trust, buoyed by years of compounding, passes to heirs at a fraction of the tax cost it would have carried outside of the CLAT framework.

For hospitals, universities, and charitable foundations, these structures are transformative. They secure long term commitments that can be projected and incorporated into capital campaigns, research programs, or community initiatives. For donors, they offer a chance to play a central role in the mission of institutions they believe in while stewarding family wealth with precision. The alignment of philanthropic purpose and tax efficiency makes the ECLAT an especially attractive solution in the modern planning environment.

At its heart, the CLAT is more than a tax tool. It embodies a principle as old as the Republic: private initiative is often the most effective means of addressing public needs. Whether structured traditionally, as a shark fin, or as an ECLAT, the trust allows families to put capital to work in ways that outlast them. For foundations facing constant demand for resources, and for families looking to make an enduring mark, the CLAT in its modern forms offers both legacy and leverage.

References

Culp, S. A., & Hatcher, R. S. (2017). Structuring charitable lead trusts to maximize benefits. Journal of Taxation, 127(2), 86-94.

Hoffman, W., Raabe, W. A., Maloney, D. M., & Young, J. C. (2021). South-Western Federal Taxation: Individual Income Taxes. Cengage Learning.

Klein, W. A., Bankman, J., & Weisbach, D. (2015). Federal Income Taxation. Wolters Kluwer.