Tax Efficient Layering™

One system. Many tools. Built to keep more in your pocket.

At AIFG we believe tax planning should work like a system — not a guessing game. That’s why we built Tax Efficient Layering™ (TEL): a proprietary planning framework that stacks multiple advanced strategies into a single, coordinated design tailored for business owners and individuals.

TEL isn't about selling products. It's about engineering the right layers to work together at the right time. The result? Optimized tax savings, more capital in motion, and a clear path to personal and financial freedom

Why it Matters

Too many entrepreneurs and professionals are stuck in reactive mode. They file taxes after the fact, follow generic CPA advice, and hope they're doing enough. Spoiler: they usually aren’t.

The tax code is written with over 70,000 pages of opportunity — most of it designed to reward planning. TEL is how we unlock that opportunity for:

Profitable business owners

Growth-minded professionals

Partners and executives planning succession or exit

If you're still using a one-size-fits-all approach, you’re leaving money on the table. TEL is how you fix that.

How It Works: Layering, Not Guessing

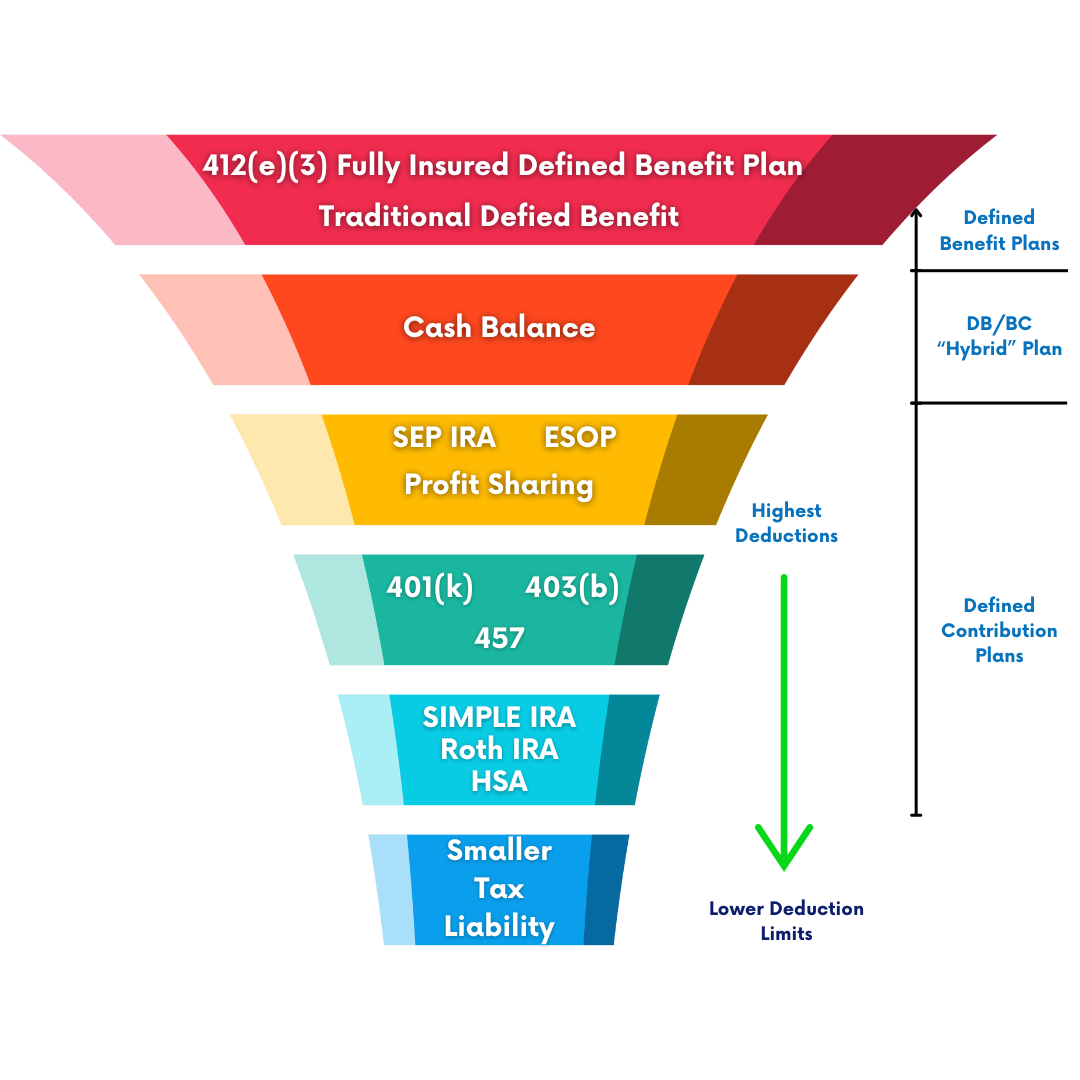

Tax Efficient Layering™ combines the best elements of:

Entity structure

Executive benefits

Retirement design

Compensation strategy

Legacy and estate tools

These aren’t random tactics. They’re deliberate layers, stacked in the right sequence to match your income, business lifecycle, team size, and personal goals.

Example Flow: Business Revenue → MSO Structure → ICHRA & Profit Sharing → 412(e)(3) Retirement → Executive Bonus → CLAT → Roth Conversion Funnel

Each layer complements the next. Together, they form a living, breathing financial engine.

Two Strategic Tracks

TEL for Business Owners

How we apply layered planning to your operating company:

Reduce tax drag on revenue

Create executive comp and retirement structures

Build long-term employee retention systems

Prepare for succession or exit

TEL for Individuals

How we help you personally harvest the benefits:

Lower your income tax liability

Reposition assets tax-efficiently

Convert business income into long-term legacy

The Tools Behind the Layers

Each TEL strategy has its own role. When layered, they multiply value.

Click Below to Examine each one.

Ready to Layer Up?

You’ve worked too hard to leave your financial future to chance. If you're ready to use the tools the ultra-wealthy have used for decades — and apply them to your business or household — let's talk.