401(k) Safe Harbor Deadlines

Your Safe Harbor 401(k) Playbook for 2025

If you want a 401(k) plan that avoids the annual tangle of IRS nondiscrimination testing, the clock is already running. The Safe Harbor design gives you a compliance shortcut but only if you meet two deadlines.

September 1, 2025 — Deliver your Safe Harbor notice to employees.

October 1, 2025 — Your plan must be live and accepting deferrals.

Miss either date and you’re stuck with full testing requirements for the year along with the risk of refunds, corrective contributions, and frustrated high earners.

Why Safe Harbor Still Wins

Safe Harbor status means you automatically pass the ADP and ACP tests. Highly compensated employees can max out contributions without worrying about refunds. Employer contributions are deductible and free from payroll tax. New plans may qualify for SECURE Act tax credits that cover much of the setup cost.

For many small and midsize companies, this is not just a compliance tool. It is a recruiting advantage. Employees see immediate, tangible value when you make contributions they can count on.

Quick Look at QACA Designs

A Qualified Automatic Contribution Arrangement or QACA is a Safe Harbor plan with automatic enrollment included. By default, employees are automatically enrolled at a set deferral rate often starting at 3 percent of pay unless they opt out. That rate must increase annually until it reaches at least 6 percent.

The QACA match formula is typically a 100 percent match on the first 1 percent of compensation plus a 50 percent match on the next 5 percent. This encourages higher savings rates without putting the entire cost burden on the employer. QACA plans also allow a two year vesting schedule unlike traditional Safe Harbor designs which require immediate vesting.

The trade off is complexity. You will need strong communication so employees understand how auto enrollment works, how to adjust contributions, and why the default increases over time.

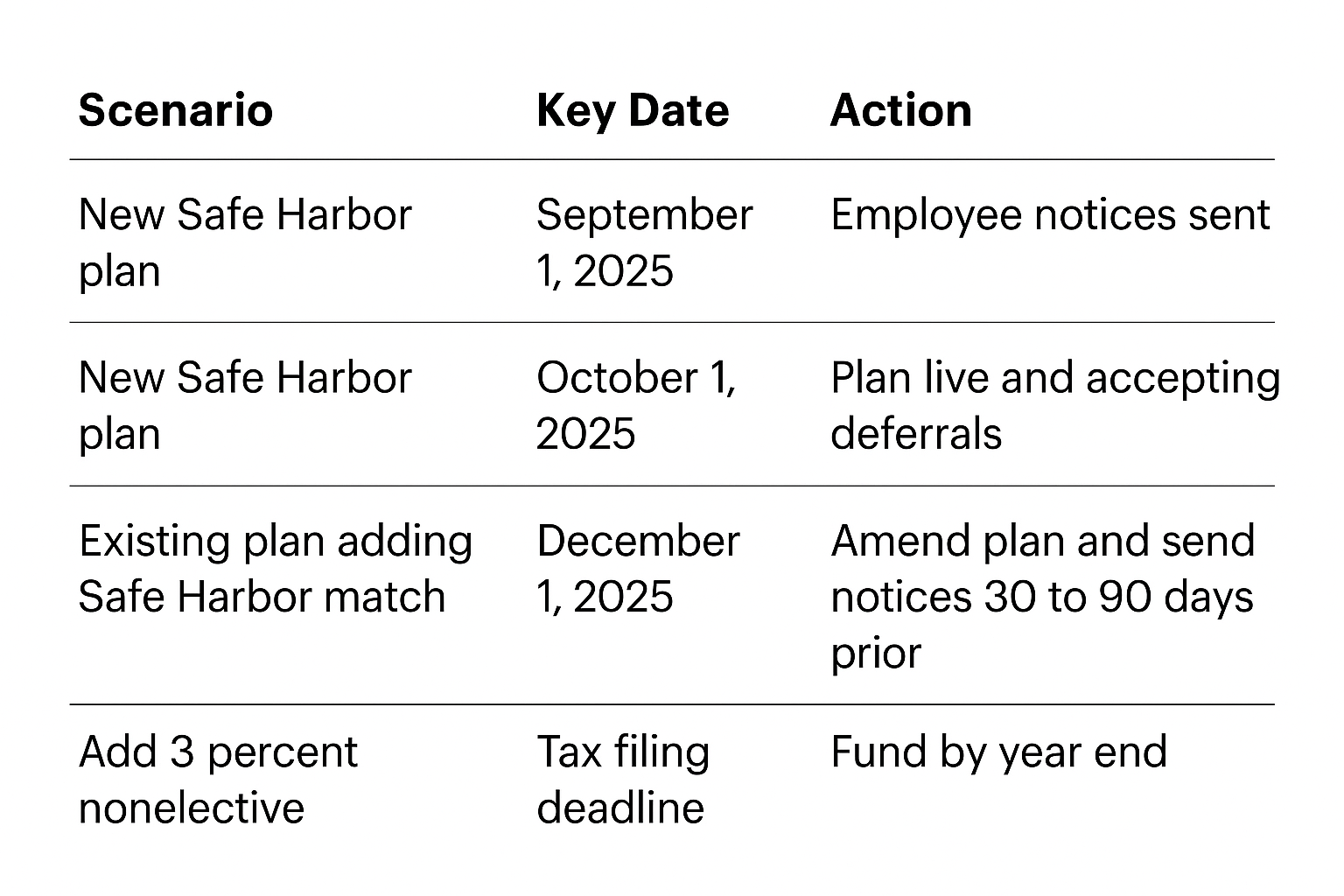

Deadlines at a Glance

If you want the Safe Harbor benefits in 2025, treat September 1 as your drop dead date for employee communication and October 1 as your launch. If QACA is on your radar, balance the automatic enrollment advantage against the higher administrative attention it requires.

This is one of those deadlines where early action pays. Wait too long and the IRS rules will do what they always do… cost you money.