Rethinking Retirement Security

How 412(e)(3) Plans Can Bridge the Growing Gap in Outcomes and Tax Efficiency

The U.S. retirement system is approaching a breaking point. Despite over $40 trillion in assets across defined contribution (DC) and defined benefit (DB) systems, a large segment of the workforce remains underprepared for retirement (1). The dominant focus on DC plans like 401(k)s, driven largely by employer cost containment and employee portability preferences, has introduced considerable risk, complexity, and inefficiency into long-term retirement planning.

While much attention has been given to expanding auto-enrollment and target-date funds, these approaches, while helpful, do not fully solve the fundamental challenges facing plan sponsors and participants alike. The erosion of guaranteed lifetime income, paired with market volatility and longevity risk, has created a vacuum in retirement security. Enter the 412(e)(3) plan—a lesser-known, fully insured defined benefit plan structure that, when layered strategically with a DC plan, can not only deliver guaranteed retirement outcomes but also unlock significant tax efficiencies for employers and business owners.

The Collapse of Confidence in Current Models

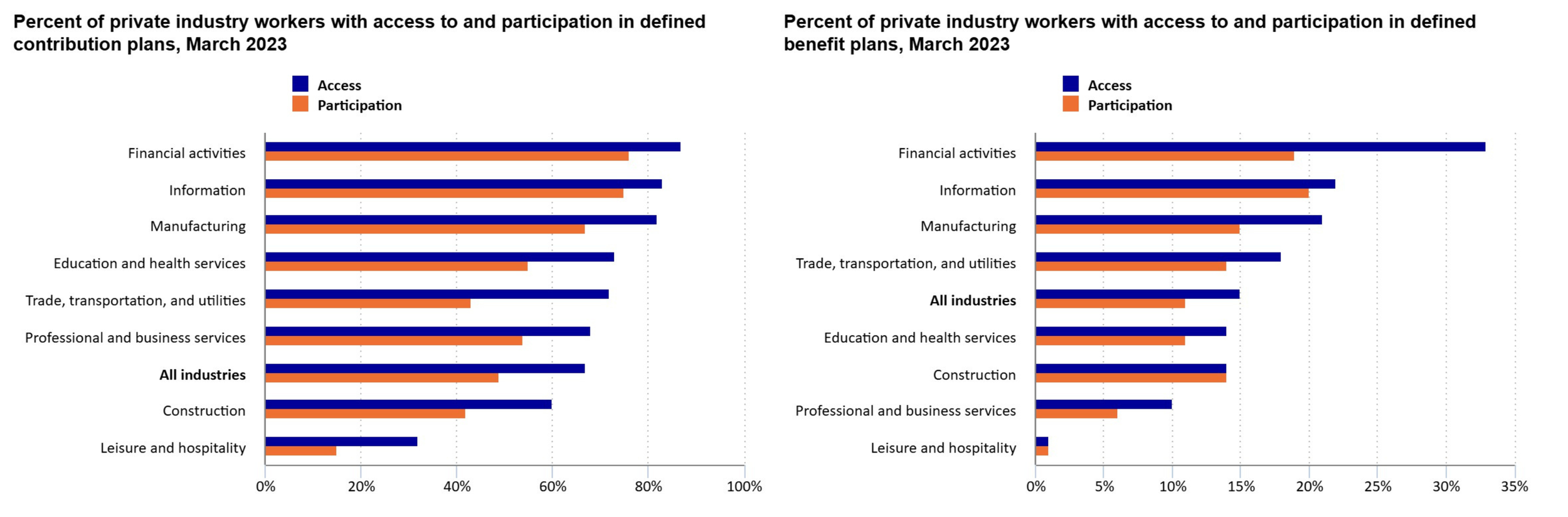

Most Americans rely heavily on defined contribution plans, yet only 40% of households aged 55–64 have any retirement savings at all (2). Even among those who do, the median account balance for that same group is just $134,000—hardly sufficient to support 20–30 years of retirement (2). Simultaneously, the decline in traditional pensions has been stark: from covering 38% of private-sector workers in 1980 to less than 15% today (3).

This shift has transferred virtually all investment and longevity risk onto the shoulders of employees. According to a 2023 survey by the Employee Benefit Research Institute, only 18% of workers feel very confident they will have enough money to live comfortably in retirement (4).

Employers, meanwhile, face a parallel problem: escalating healthcare costs, fierce competition for talent, and a complicated regulatory environment. Add to that the complexity of designing benefit plans that balance affordability, attractiveness, and tax efficiency, and it's no wonder many settle for the default DC plan—even if it doesn't fully meet their objectives.

412(e)(3): A Quiet Powerhouse

The 412(e)(3) plan, under IRS Code Section 412(e)(3), is a fully insured defined benefit plan funded exclusively through fixed annuities or a combination of annuities and whole life insurance contracts. It is exempt from many of the traditional actuarial funding requirements because the guarantees are underwritten by insurance carriers.

This structure brings with it several powerful advantages, especially for closely held businesses or high-income employers:

Guaranteed Outcomes: Contributions are contractually determined to fund a specific retirement benefit. There's no guessing based on market returns—unlike a 401(k), where the final outcome is undefined.

Accelerated Deductions: Contributions often exceed those of standard DC plans, particularly for older owners or key employees. For example, a 60-year-old could deduct well over $200,000 per year, depending on the design and benefit target (5).

Creditor Protection and Conservative Investment Mandate: The reliance on insurance guarantees ensures conservative, predictable funding and makes the assets attractive from a risk mitigation standpoint.

Ease of Administration: Without the need for ongoing actuarial valuations, the compliance burden is often reduced compared to traditional DB plans.

It’s Not Either/Or—It’s Often Both

Many employers falsely believe they must choose between a defined benefit plan and a defined contribution plan. In truth, the optimal design often includes both. The IRS permits plan sponsors to implement both a 412(e)(3) plan and a 401(k)/profit-sharing plan concurrently, allowing for "Tax Efficient Layering" that maximizes deductions and retirement security in tandem.

This design offers tiered benefits: the DB plan delivers guaranteed income, while the DC plan allows for additional elective deferrals, Roth contributions, and discretionary employer match or profit sharing. The end result is a comprehensive solution that addresses the full retirement need spectrum, especially for older or highly compensated employees.

As of 2023, only 4% of private employers offer both types of plans (6). This underutilization leaves billions of dollars of tax-favored contributions on the table annually. Given that over 70% of small business owners are over the age of 50, the demographic alignment for layered planning is striking (7).

Large Employer Carve-Out Strategies

For larger employers seeking to provide enhanced retirement or insurance benefits to select groups of executives, 412(e)(3) plans can be structured in conjunction with 401(k) and profit-sharing programs to comply with nondiscrimination requirements while still offering outsized value to top earners. Under Treasury Regulation §1.401(a)(4)-5(b), employers may test benefits on a rate group basis, enabling a carve-out of a limited class of employees—such as executives or partners—for defined benefit coverage while satisfying fairness rules through broader defined contribution benefits (10). When at least 7.5% of compensation is contributed to rank-and-file employees through a safe harbor 401(k) match and/or profit-sharing plan, many companies can fund life insurance-backed 412(e)(3) pensions for a smaller group—often around 40% of eligible employees, capped at 125—without running afoul of minimum coverage or nondiscrimination rules under IRC §410(b) (11). This carve-out design is especially powerful for organizations with complex compensation tiers or substantial income disparities across roles.

The Tax Code Was Built with the Wealthy in Mind—Use It Accordingly

The tax code is not inherently fair—but it is predictable. The rules around qualified retirement plans disproportionately benefit older, higher-income earners precisely because they allow for back-loaded contributions based on years of service and projected retirement benefits.

A 412(e)(3) plan allows savvy business owners to redirect taxable income into protected, growing, and guaranteed retirement assets. These deductions not only lower current tax liabilities but also shift wealth from fully taxable income to future tax-advantaged or tax-neutral distributions, depending on the overall planning structure.

When combined with a well-designed 401(k) profit-sharing plan, the business owner may be able to deduct between $250,000 and $350,000 annually, while also covering staff in a compliant, equitable manner. These are not exotic or gray-zone strategies—they are foundational building blocks of the Internal Revenue Code.

The Reality of Lifetime Income: A Renewed Mandate

In 2019, the SECURE Act introduced a new emphasis on lifetime income disclosures, and SECURE 2.0 has continued that trend by encouraging annuitization and in-plan guaranteed options. Still, less than 10% of plans currently offer lifetime income features (8). Why? Plan sponsors often cite fiduciary risk and complexity, despite growing demand. Surveys show 78% of workers would prefer a retirement plan with guaranteed lifetime income over one with higher but uncertain returns (9).

412(e)(3) sidesteps the complexity by placing the income guarantee at the plan’s core. It's not a feature—it's the foundation. For employers looking to create real retirement outcomes without the fiduciary tangle of in-plan annuities, it may be the ideal mechanism.

The Hidden Solution for a Visible Crisis

As both plan sponsors and policymakers scramble to patch the holes in America’s fraying retirement system, it’s worth revisiting tools that have been here all along. The 412(e)(3) plan isn’t new, but its relevance is more pronounced than ever.

When layered with defined contribution offerings, it creates a structure capable of delivering guaranteed income, maximizing tax deductions, and solving for both employer liability and employee security in one elegant structure. For business owners and professionals frustrated with the limitations of traditional 401(k)s, the answer may not lie in Wall Street—but in the quiet certainty of a well-funded insurance contract.

Sources Cited:

Investment Company Institute. (2024). Retirement Market Statistics. https://www.ici.org/statistical-report/retirement-assets

Federal Reserve. (2023). Survey of Consumer Finances. https://www.federalreserve.gov/econres/scfindex.htm

U.S. Bureau of Labor Statistics. (2023). National Compensation Survey. https://www.bls.gov/ncs/

Employee Benefit Research Institute. (2023). 2023 Retirement Confidence Survey. https://www.ebri.org/retirement/

IRS. (2024). Contributions and Deduction Limits for Retirement Plans. https://www.irs.gov/retirement-plans

U.S. Department of Labor. (2023). Private Pension Plan Bulletin: Abstract of 2021 Form 5500 Annual Reports. https://www.dol.gov/agencies/ebsa

SCORE. (2022). Small Business Owner Demographics. https://www.score.org

Plan Sponsor Council of America. (2023). 2023 Annual Survey of Profit Sharing and 401(k) Plans. https://www.psca.org

Allianz Life Insurance Company. (2023). Annual Retirement Study. https://www.allianzlife.com

U.S. Department of the Treasury. (2003). 26 CFR §1.401(a)(4)-5 – Nondiscriminatory employee contributions or benefits—Testing on a benefits basis. https://www.ecfr.gov/current/title-26/section-1.401(a)(4)-5

U.S. Department of the Treasury. (2003). 26 CFR §1.410(b)-4 – Permissive aggregation of plans. https://www.ecfr.gov/current/title-26/section-1.410(b)-4